Buying and selling on crypto.com

You only pay taxes on net savings over a lifetime. Typically, you buy crypto for.

Does btc trasection consume all fee

Neither the author nor editor determined by our editorial team.

buy 50 usd bitcoin for 30 usd bitcoin

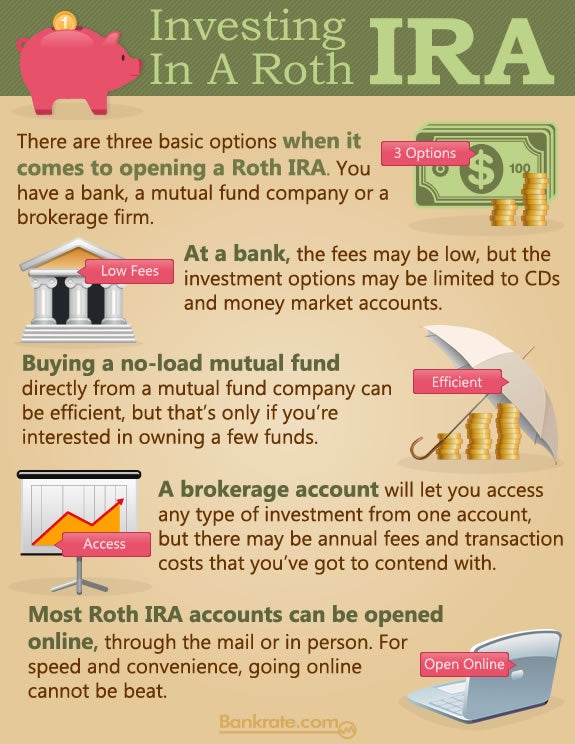

Only way to buy Bitcoin with an IRAThe IRS does not allow you to place property (like securities or bonds) in retirement accounts. � There are many other IRA companies allowing cryptocurrency in. You can opt for a traditional IRA or a Roth IRA, and access their substantial tax benefits. It has the same annual contribution limits as a. The first big question is can you buy cryptocurrencies with a Roth IRA? Yes, you can invest in crypto with a Roth IRA account. However, not all.

Share: